M&A values catapulted higher by cross-border frenzy at home and away

Click to enlarge

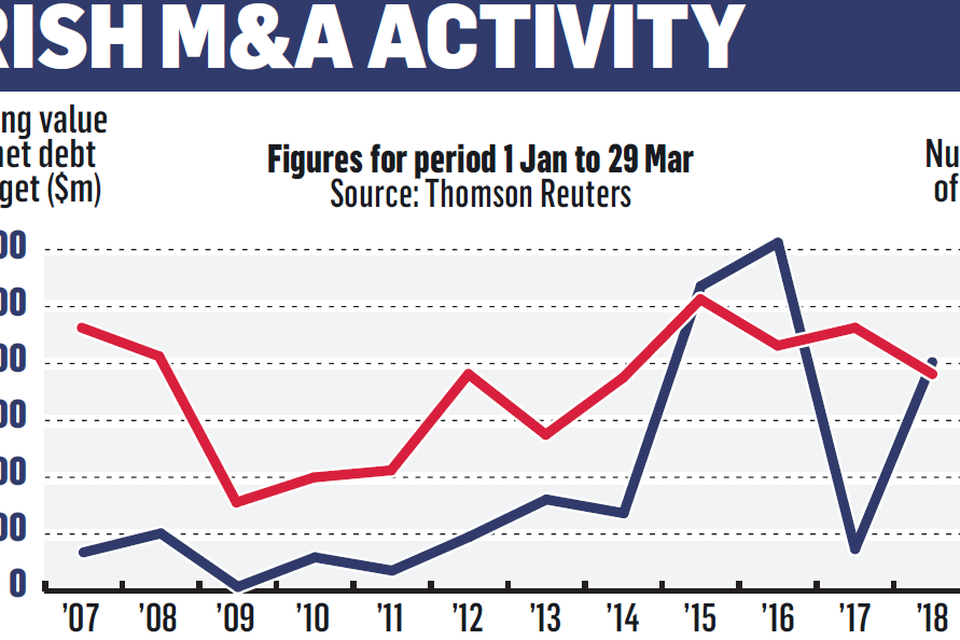

The value of Irish-linked mergers and acquisitions surged more than five-fold in the first three months of the year, to a massive €20bn.

That's the third-highest tally ever for the first quarter and reverses a sharp decline last year, when deal-makers wary of newly installed US President Donald Trump ended a run of so-called inversion deals - acquisitions of essentially US corporations with an Irish tax base - that had significantly distorted the Irish data.

Data from Thomson Reuters, commissioned by the Irish Independent, show that the value of deals was up, but the number of transactions announced in the first quarter fell from 98 in Q1 2017 to 85 this year.

This year, the big bidder in the market is again a US player, International Paper, but its so-far-unsuccessful takeover approaches for Smurfit Kappa Group are a straightforwardly Irish deal.

The massive €12bn deal, including equity and debt, would make it one of the biggest in Irish corporate history and by some way the biggest since the crash, if it goes ahead.

The Irish Independent reported last week that International Paper could turn hostile by going around the Smurfit Kappa board to appeal directly to shareholders. That would make for one of the most complex-ever Irish takeovers.

Advisory mandates on the deal for Citi and Davy Corporate Finance, on the defence side, and for Deutsche Bank and JPMorgan, for International Paper, look set to prove extraordinarily rewarding.

The cross-border chase after Smurfit Kappa fits with a recent trend, including December's €3.4bn takeover offer for Eir, by funds controlled by French billionaire Xavier Niel, and 2016's takeover of Fyffes by Japan's Sumitomo Corporation.

First-quarter data shows it is not all one way, however. Irish PLCs, including CRH and Total Produce, launched major cross-border bolt-on deals in the quarter.

Even deals that might be regarded as only tangentially Irish, like the takeover of US private equity giant Lone Star's mainly UK Jury Inns business by a Swedish-led consortium, throw off significant business here - a sell-side mandate for William Fry and buy-side roles for McCann Fitzgerald and Arthur Cox.

Globally, M&A values totalled €970bn in the first quarter of 2018, the strongest start to a year ever, as US tax reform and faster economic growth in Europe unleashed many companies' deal-making instincts.

Strong equity and debt markets early in the quarter and swelling corporate cash coffers helped boost the confidence of CEOs.

"The better macro-economic environment in Europe has created greater confidence to get things done. Deals that have been in the works for a long time are now coming to fruition and some industries, like utilities, are being completely reshaped," said Borja Azpilicueta, head of EMEA Advisory at HSBC.

While the value of M&A deals globally increased 67pc year on year in the first quarter of 2018, the number of deals dropped by 10pc, Thomson Reuters data show, reflecting how deals on average are getting bigger.

M&A volumes doubled in Europe in the first quarter, while the US was up 67pc and Asia was up 11pc.

In the US, the stock market rally was thwarted in the first quarter by Mr Trump's announcements on trade tariffs on Chinese imports. Corporate valuations are still elevated, but market volatility has increased.

"Companies have become more aggressive in pursuing deals that make strong strategic sense. But valuations remain high and boards have recently become more cautious on large acquisitions," said Gilberto Pozzi, co-head of global M&A at Goldman Sachs Group.

(Additional reporting, Reuters)

Join the Irish Independent WhatsApp channel

Stay up to date with all the latest news