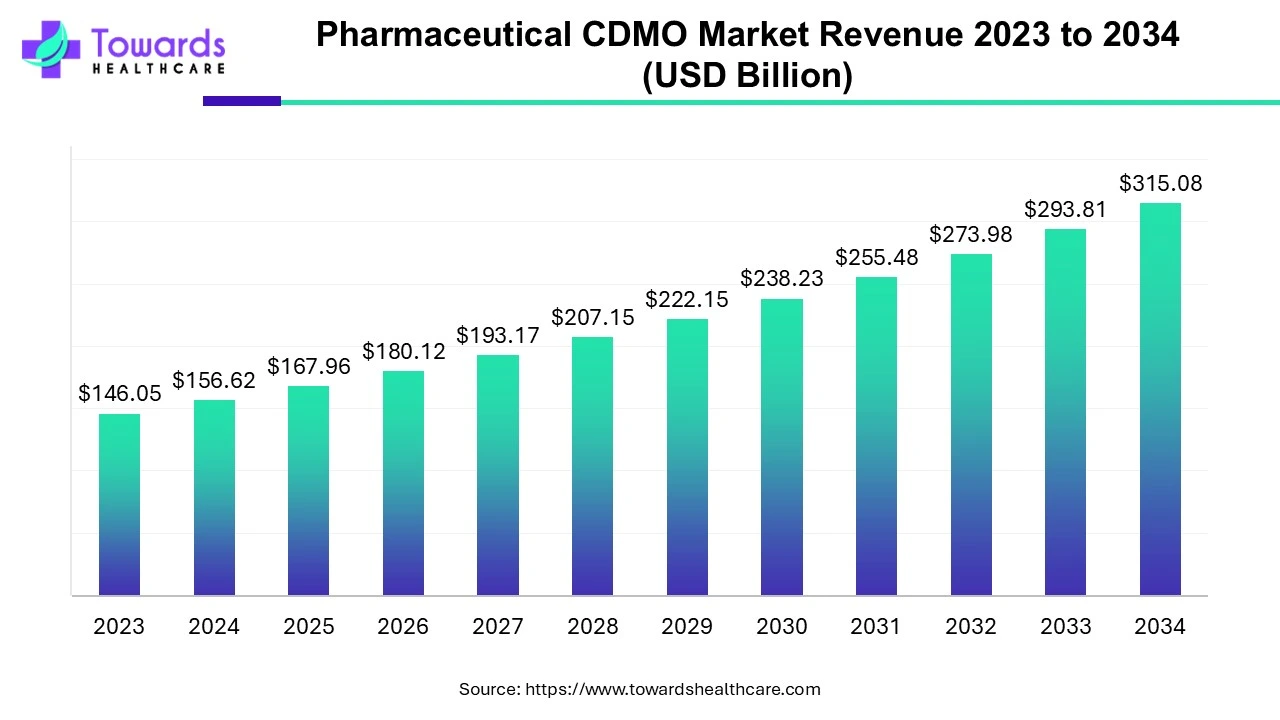

Pharmaceutical CDMO Market Set to Surpass $315.08 Billion by 2034, Driven by 7.24% CAGR

According to Towards Healthcare research, the global pharmaceutical CDMO market size is calculated at USD 167.96 billion in 2025 and is expected to reach around USD 315.08 billion by 2034, growing at a CAGR of 7.24% for the forecasted period.

/EIN News/ -- Ottawa, May 06, 2025 (GLOBE NEWSWIRE) -- The global pharmaceutical CDMO market size was valued at USD 156.62 billion in 2024 and is predicted to hit around USD 315.08 billion by 2034, a study published by Towards Healthcare a sister firm of Precedence Research.

The market is driven by growing research and development activities and the increasing demand for biologicals. North America dominated the global market due to the rising adoption of advanced technologies and increasing investments.

Get All the Details in Our Solutions – Request a Brochure: https://www.towardshealthcare.com/download-brochure/5327

Pharmaceutical CDMO Market Overview

Contract development manufacturing organization (CDMO) provides pharmaceutical research and manufacturing outsourcing services. They carry out numerous tasks, such as active pharmaceutical ingredient (API) and biologics development, formulation, regulatory compliance, clinical trial management, upscaling, and commercial production. They provide relevant expertise in technical tasks, allowing pharmaceutical and biotechnology companies to focus on product marketing and distribution. CDMOs assist in large-scale manufacturing, allowing companies to opt for cost-effective solutions. They also increase the development speed, reducing the time spent on facility setup and validation.

Pharmaceutical CDMO Market Trends

- Growing R&D Activities: Researchers are continuously developing novel pharmaceuticals and biopharmaceuticals for advanced treatment. The need for personalized medicines also encourages researchers to develop more targeted therapeutics.

- Demand for Biologics: The large-scale production of numerous biologics, such as cell and gene therapy, vaccines, blood products, and monoclonal antibody therapeutics, is complex. This is due to their high sensitivity and dependence on living systems for manufacturing. CDMOs provide the necessary expertise and facilities for developing biologics.

-

Increasing Mergers and Acquisitions: The increasing collaborations and mergers & acquisitions among pharmaceutical companies and CDMOs lead to flexibility and scalability in the development and manufacturing process. CDMOs also collaborate among themselves to expand their client base and access new technologies.

Limitations & Challenges in the Pharmaceutical CDMO Market

- Complex Regulatory Framework: Various regulatory agencies of different countries have certain regulatory guidelines for the manufacturing and marketing of pharmaceuticals and biologics. CDMOs need to comply with the regulatory guidelines of all nations. This increases the complexity in marketing and reduces the time to market.

- Supply Chain Disruption: Supply chain disruption may lead to drug shortages, resulting in lost market opportunities and inability to satisfy patient demand. The increasing transportation cost and geopolitical disruption may affect the supply chain of pharmaceuticals.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Digital Automation: The Rise of CDMO 2.0

Artificial intelligence (AI) and machine learning (ML) algorithms are integrated into every step of drug development. Digital infrastructure drives efficiency and transparency in the business. AI and ML expedite the discovery process, allowing CDMOs to screen from a vast library of compounds virtually and develop more potent compounds. They also reduce R&D costs and increase the probability of technical success across early and late stages of drug development. They can also streamline manufacturing, optimizing critical process parameters and enhancing product quality. Predictive analytics enables manufacturers to detect potential errors, allowing them to make proactive decisions.

For instance,

-

In April 2025, Honeywell launched the TrackWise Manufacturing platform to digitize operations and automate workflows in life science manufacturing. The platform is embedded with AI and cloud-native technologies.

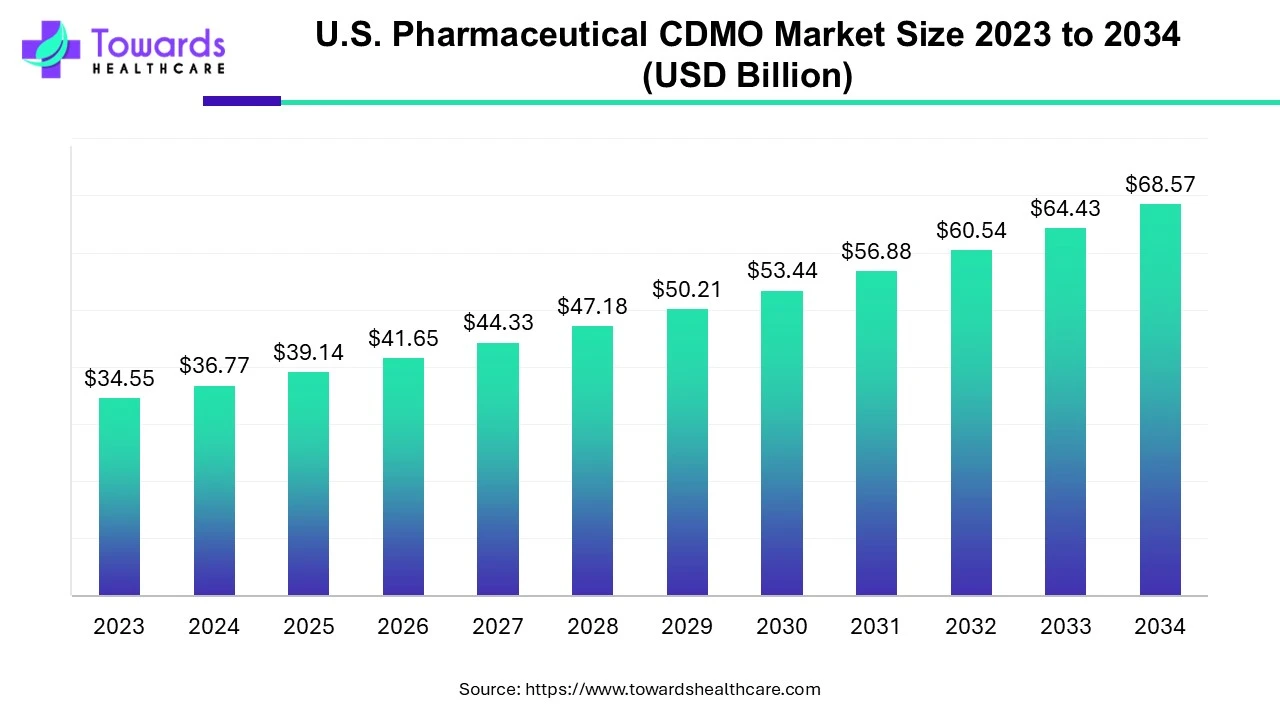

U.S. Pharmaceutical CDMO Market Insights

The U.S. market is driven by several factors, including the presence of key players and favorable government support. Key players like Thermo Fisher Scientific, Catalent Pharma Solutions, and Pfizer CentreOne hold the major share of the market. The U.S. government provides funding for conducting research through the National Institutes of Health. The budget for FY 2025 is $48.5 billion. The increasing number of clinical trials also contributes to the market. The U.S. conducts the highest number of clinical trials globally, accounting for 181,816 clinical trials as of April 2025. New product approvals necessitate commercial manufacturing to reduce drug shortages. The U.S. Food and Drug Administration (FDA) approved a total of 50 new drugs in 2024.

The U.S. pharmaceutical CDMO market size is calculated at USD 36.77 billion in 2024, grew to USD 39.14 billion in 2025, and is projected to reach around USD 68.57 billion by 2034. The market is expanding at a CAGR of 6.43% between 2025 and 2034.

Download the brochure for insights into U.S. Pharmaceutical CDMO Market: https://www.towardshealthcare.com/download-brochure/5407

Regional Analysis

Suitable Manufacturing Infrastructure Promotes Asia-Pacific

Asia-Pacific dominated the pharmaceutical CDMO market in 2024. The increasing number of pharma and biotech startups potentiates the need for a CDMO due to a lack of appropriate facilities and funding. The rapidly expanding pharma and biotech sector fosters market growth. The presence of suitable manufacturing infrastructure and the availability of affordable technicians encourage foreign players to set up their manufacturing facilities in Asia-Pacific countries.

- China: China has more than 10,000 major pharmaceutical industrial enterprises. In September 2024, China eased restrictions on foreign investment in the development and application of human stem cells, gene therapy, and genetic diagnosis technologies within Beijing, Shanghai, Guangdong, and Hainan.

- India: As of June 2024, there were 2,127 startups related to the pharmaceutical sector. The increasing exports of pharmaceuticals also boost the market. India dominates the over-the-counter (OTC) drugs export in the U.S. with over 40% of the market share. India also accounts for 60% of the global vaccine production.

Elevate your healthcare strategy with Towards Healthcare. Enhance efficiency and drive better outcomes—schedule a call today: https://www.towardshealthcare.com/schedule-meeting

Rising M&A Activities Dominated North America

North America is estimated to grow at the fastest CAGR during the forecast period. The rising adoption of advanced technologies and increasing investments are the major growth factors of the market. The increasing number of pharmaceutical CDMOs and mergers & acquisitions promote market growth. There were 191 M&A deals in Q3 2024, amounting to $18.2 billion, in North America. Additionally, in 2023, North America accounted for 53.3% of pharmaceutical sales globally. Favorable government support and suitable regulatory frameworks augment the market.

-

Canada: Canada is the 8th largest world market in pharmaceutical sales, contributing to a 2.2% share of the global market. Canada comprises around 3,000 pharmaceutical companies and over 10,500 manufacturing facilities. Moreover, out of 191 M&A deals in North America, 12 were from Canada with a value of $1.2 billion.

Europe’s Pharmaceutical CDMO Market: Driving the Next Wave of Pharma Innovation

Contract Development and Manufacturing Organizations, or CDMOs, play a vital role in the pharmaceutical world. They provide end-to-end services—from drug formulation and development to large-scale manufacturing and supply chain management. For pharmaceutical and biotech companies, working with CDMOs means gaining access to advanced facilities, cutting-edge research capabilities, and regulatory expertise—all while keeping costs down and speeding up time to market. By outsourcing specific steps or entire processes, pharma companies can stay focused on what they do best: discovering new drugs and getting them into the hands of patients.

Across Europe, investment in pharmaceutical R&D is ramping up. Companies are working hard to turn cutting-edge research into real-world treatments that are both accessible and effective. With chronic diseases on the rise, the pressure to develop innovative therapies is higher than ever. As a result, there’s a growing demand for advanced manufacturing technologies and expert partners—pushing the CDMO market forward.

What’s fueling this growth? In addition to rising demand, we’re seeing a surge in strategic collaborations, investments, and mergers and acquisitions. Add to that a supportive regulatory environment and Europe’s strong footprint in global pharma—responsible for 22.7% of global pharmaceutical sales in 2023—and it’s clear the region is poised for continued expansion.

In numbers, the European pharmaceutical CDMO market was valued at USD 35.48 billion in 2024 and is expected to grow to USD 37.98 billion in 2025. Looking ahead, the market is projected to reach approximately USD 70.05 billion by 2034, growing at a healthy CAGR of 7.04%. With ongoing innovation, government support, and strong industry demand, CDMOs are set to play an even bigger role in shaping the future of European pharma.

Download the brochure for insights into Europe’s Pharmaceutical CDMO Market: https://www.towardshealthcare.com/download-brochure/5412

Segmental Outlook

Product Insights

The API segment held a dominant presence in the pharmaceutical CDMO market in 2024 and is projected to expand rapidly in the market in the coming years. The growing demand for small molecules as therapeutics boosts the segment’s growth. The demand for small molecules is increasing due to their affordability and easy manufacturing. The U.S. FDA approved 31 novel molecular entities, while China’s NMPA approved 46 novel small-molecule drugs in 2024. The availability of generic drugs also increases the demand for CDMOs. Small molecule CDMOs provide advanced formulation services tailored to the specific needs of each drug. They enable manufacturing sterile and non-sterile liquids, solids, and semi-solids.

Workflow Insights

The commercial segment held the largest share of the market in 2024. Pharmaceutical CDMO assists in the large-scale manufacturing of pharmaceuticals and biopharmaceuticals. The rising consumer demands and the need for faster time to market augment the segment’s growth. Hence, CDMOs ensure the distribution of pharmaceuticals for a large patient population. The growing demand for generic pharmaceuticals and personalized medicines also contributes to the segment’s growth.

Application Insights

The oncology segment registered its dominance over the global pharmaceutical CDMO market in 2024. The rising prevalence of cancer and growing research and development activities for novel cancer therapeutics propel the segment’s growth. The American Cancer Society estimated more than 2 million new cancer cases in the U.S. in 2025. There are around 321 licensed anticancer drugs available in the market. Advancements in genomics and proteomics enable researchers to study cancer progression. This encourages them to develop personalized therapeutics based on patients’ genetic information.

End-Use Insights

The large pharmaceutical companies segment led the global market in 2024 and is expected to grow at the fastest rate in the market during the forecast period. Large pharmaceutical companies have suitable capital investment. They are involved in multiple projects simultaneously, necessitating outsourcing their development and manufacturing services. CDMOs eliminate the need to set up a specialized facility based on product requirements. The availability of state-of-the-art research and development facilities and increasing market competition foster the segment’s growth. Customized outsourcing services facilitate new product launches and reduce time to market, strengthening their market position.

Get the latest insights on healthcare industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Top Companies in the Pharmaceutical CDMO Market

- Veranova

- Sterling

- Pfizer Centre One

- Evonik

- CordenPharma International

- Piramal Pharma Solutions

- Samsung Biologics

- WuXi AppTec, Inc.

- EuroAPI

- Laboratory Corporation of America Holdings (LabCorp)

- Nipro Corporation

- Catalent, Inc.

- Thermo Fisher Scientific, Inc.

- Recipharm AB

- Axplora

- Lonza Group

Recent Breakthroughs in the Pharmaceutical CDMO Market

- In April 2025, Meribel Pharma Solutions launched a new mid-sized CDMO with an extensive integrated network across Europe. The facility was launched to deliver the highest quality solutions and services, enabling customers to scale to new heights.

- In March 2025, Shilpa Medicare launched a new full-service hybrid CDMO serving both small and large molecules customers as well as peptides with extensive expertise in oncology. The hybrid CDMO also offers commercially ready “off-the-shelf” novel formulations for exclusive b2b licensing.

Browse More Insights of Towards Healthcare:

- CDMO Aseptic Filling Solutions Market: https://www.towardshealthcare.com/insights/cdmo-aseptic-filling-solutions-market-sizing

- Active Pharmaceutical Ingredients CDMO Market: https://www.towardshealthcare.com/insights/active-pharmaceutical-ingredients-cdmo-market-sizing

- Oligonucleotide CDMO Market: https://www.towardshealthcare.com/insights/oligonucleotide-cdmo-market-sizing

- Topical Drugs CDMO Market: https://www.towardshealthcare.com/insights/topical-drugs-cdmo-market-sizing

- Cell and Gene Therapy CDMO Market: https://www.towardshealthcare.com/insights/cell-and-gene-therapy-cdmo-market-sizing

- Biologics CDMO Market: https://www.towardshealthcare.com/insights/biologics-cdmo-market-sizing

- Biopharmaceutical Third-Party Logistics Market: https://www.towardshealthcare.com/insights/biopharmaceutical-third-party-logistics-market-sizing

- Pharma Contract Research Organization (CRO) Services Market: https://www.towardshealthcare.com/insights/pharma-contract-research-organization-cro-services-market-sizing

- Cold Chain Pharmaceuticals Market: https://www.towardshealthcare.com/insights/cold-chain-pharmaceuticals-market-sizing

- Pharmaceutical Excipients Market: https://www.towardshealthcare.com/insights/pharmaceutical-excipients-market-sizing

Segments Covered in the Report

By Product

- API

- Type

- Traditional API

- Highly Potent API

- Antibody-Drug Conjugate (ADC)

- Others

- Synthesis

- Synthetic

- Solid

- Liquid

- Biotech

- Synthetic

- Drug

- Innovative

- Generics

- Manufacturing

- Continuous Manufacturing

- Batch Manufacturing

- Type

- Drug Product

- Oral Solid Dose

- Semi-Solid Dose

- Liquid Dose

- Others

By Workflow

- Commercial

- Clinical

By Application

- Oncology

- Small Molecules

- Biologics

- Infectious Diseases

- Neurological Disorders

- Cardiovascular Disease

- Metabolic Disorders

- Autoimmune Diseases

- Respiratory Diseases

- Ophthalmology

- Gastrointestinal Disorders

- Hormonal Disorders

- Hematological Disorders

- Others

By End-Use

- Large Pharmaceutical Companies

- Medium Pharmaceutical Companies

- Small Pharmaceutical Companies

By Region

- North America

- US

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

To invest in our premium strategic solution and customized market report options, click here: https://www.towardshealthcare.com/price/5327

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

Distribution channels: Consumer Goods ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release