Outsource Accounts Payable Services Unlock Cost Savings and Reliability for Washington Firms

Washington businesses enhance efficiency, reduce costs, and improve compliance with expert-led outsource accounts payable services.

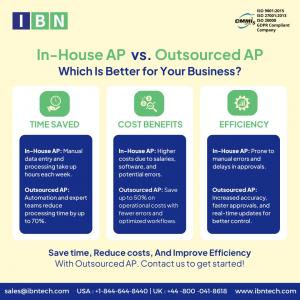

MIAMI, FL, UNITED STATES, June 5, 2025 /EINPresswire.com/ -- To save expenses and improve operational effectiveness, businesses in Washington choose to outsource accounts payable services as the business environment becomes more complicated. Businesses in a variety of industries, including manufacturing, technology, healthcare, and retail, depend on knowledgeable suppliers to improve their financial processes and expedite vendor payments. The increasing strain of manual procedures, the necessity to adapt to a remote workforce, and the imperative requirement to maintain compliance with changing rules are the reasons behind this change. Businesses of all sizes may access qualified experts, save costs, and reallocate resources to vital business goals by outsourcing accounts payable services.In addition to providing operational assistance, these services improve cash flow management and financial obligation clarity, which makes more strategic planning and decision-making possible. Accuracy is maintained throughout the payables cycle by organizations identifying problems early thanks to standardized protocols and instant access to data. Reputable businesses like IBN Technologies provide dependable online accounts payable services together with industry knowledge to guarantee on-time payments and cultivate positive vendor relationships. Customers that deal with these partners benefit from increased process efficiency and have more financial control.

Gain greater control over your payables — schedule your free consultation today!

Consultation link: https://www.ibntech.com/free-consultation-for-ap-ar-management/

Addressing Challenges in Today’s Accounts Payable Environment

Ineffective accounts For Washington firms, accounts payable procedures and disjointed financial systems provide significant obstacles. The need for accuracy and consistency in financial operations has increased due to increased regulatory scrutiny and rising vendor expectations for on-time payments. There is pressure on the company's leadership to increase accountability and optimize processes.

Common obstacles include:

1. Manual, fragmented invoice processing

2. Missed opportunities for early payment discounts and frequent payment delays

3. High operational costs tied to legacy paper-based methods

4. Limited insight into outstanding liabilities

5. Increased compliance risks with complex regulatory changes

6. Strained supplier relationships caused by inconsistent payment schedules

7. Difficulties consolidating payables across multiple departments or entities

These issues often translate into cash flow problems, audit risks, and weakened supplier trust. To combat these risks, many organizations engage accounts payable outsource providers who offer customized solutions combining disciplined accounts payable process flow with professional expertise. Firms like IBN Technologies empower clients to manage obligations effectively, enhance operational workflows, and preserve strong supplier partnerships.

Enhancing Financial Operations with Outsourced Expertise

Businesses may increase accuracy, efficiency, and compliance by outsourcing accounts payable services. By collaborating with trustworthy suppliers of accounts payable solutions, businesses may streamline operations and raise overall financial performance. Typical essential elements of these contracted services are:

✅ Accurate accounts payable invoice processing from receipt to final payment ensuring prompt and reliable transactions

✅ Effective vendor data management and communication to support smooth payment cycles

✅ Expense monitoring and control to maximize cash flow and reduce unnecessary costs

✅ Payment execution in strict adherence to contractual terms to avoid penalties

✅ To ensure accuracy and adherence to financial requirements, regular reconciliation is necessary.

✅ Detailed reporting and analytics to monitor payable performance, assess spending patterns, and aid decision-making

To reduce the effort of internal teams while preserving accuracy and regulatory compliance, IBN Technologies provides full outsource accounts payable services. Businesses may prioritize their growth objectives thanks to this method, which not only simplifies payables but also encourages cost reductions and better cash management.

Key Advantages of IBN Technologies’ Outsourced Accounts Payable Services

Outsourcing accounts payable simplifies financial management, reduces expenses, and guarantees timely and precise payments. With expert guidance, businesses maintain smooth operations while focusing on their primary objectives. The benefits include:

✅ Precise handling of vendor data for seamless payment processing

✅ Improved collection and reduced exposure to bad debts

✅ Consistent ledger updates in accordance with GAAP standards

✅ Clear cash flow forecasting to enhance financial oversight

✅ Reduced mistakes and expedited invoice processing, demonstrating the accounts payable benefits

Proven Success and Client Satisfaction

IBN Technologies has consistently enabled numerous businesses to enhance their accounts payable processes:

• Customers report that there are less payment delays and a roughly 40% improvement in cash flow efficiency.

• Improved process management facilitates more vendor engagement and cost savings.

The Future of Accounts Payable Outsourcing with IBN Technologies

Businesses are adopting flexible, secure, and virtual-capable solutions to stay competitive as the need for outsource accounts payable services keeps growing. Improved data security, real-time insights, and smooth process automation will be prioritized in the future to increase control and transparency. Adopting these innovations will help those that handle complicated payment situations more effectively, adjust quickly to changes in the market, and maximize cash flow while reducing operational risks.

IBN Technologies distinguishes itself in this market by providing customized accounts payable process flow solutions that adjust to changing industry requirements and regulatory frameworks. They convert conventional accounts payable procedures into strategic financial benefits that promote agility and long-term success by assisting companies in streamlining operations and scaling effectively.

Related Service:

Outsourced Finance and Accounting https://www.ibntech.com/finance-and-accounting-services/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release