Unlocking Nigeria’s $3 Billion Consumer Credit Market as Nigeria Appoints New NCCC CEO

Following President Bola Tinubu’s appointment of the new CEO of the Nigerian Consumer Credit Corporation, Stears introduced its new Credit Market Mapping Model

LAGOS, NIGERIA, April 18, 2024 /EINPresswire.com/ -- Following President Bola Tinubu’s appointment of Uzoma Nwagba as the Managing Director/Chief Executive Officer of the Nigerian Consumer Credit Corporation to boost financial inclusion across Nigeria, Stears is pleased to introduce its new Credit Market Mapping Model, a tool designed to help understand Nigeria’s consumer lending landscape.The current absence of recent and relevant credit demand data poses challenges for commercial banks, digital lenders, microfinance institutions, and potential investors, leaving them effectively 'market-blind' and unable to estimate Nigeria’s actual consumer credit market size. Stears’ Credit Market Mapping Model addresses this critical need by leveraging robust data and innovative methodologies to provide a comprehensive understanding of Nigeria's consumer credit market.

According to a 2023 survey by EFInA, 32% of Nigerian adults, approximately 39 million individuals, rely on informal sources for financial assistance. Stears goes beyond assessing the formal market, offering insights into the substantial informal credit market and identifying opportunities for credit providers and investors within this segment.

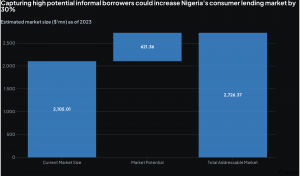

Stears’ Credit Market Mapping Model offers three key outputs: (i) Current Market Size: Providing insights into the current consumer credit market size; (ii) Potential Market Size: Identifying untapped potential within the population likely to transition from informal to formal borrowing; and (iii) Scenario Analysis: Evaluating the impact of changing macroeconomic variables on market potential.

“Our model fills a crucial gap in the market by providing accurate and actionable insights into Nigeria’s consumer credit landscape,” said Michael Famoroti, Head of Intelligence at Stears. “By combining robust data with innovative methodologies, we offer investors and credit providers a dynamic tool to assess market potential and capitalize on emerging opportunities.”

Using EFInA's nationally representative survey data and advanced regression analysis, Stears estimates Nigeria’s consumer credit market size at $2.1 billion, with an additional $621 million in untapped potential within the informal borrowing segment.

“Our scenario analysis feature allows users to anticipate market outcomes based on varying assumptions, empowering them to make informed decisions in a rapidly evolving economic environment,” added Famoroti.

Stears’ Credit Market Mapping Model is available to its customers. Organisations interested in accessing this invaluable tool can request a demo.

Abdul Abdulrahim

Stears

abdul@stears.co

Visit us on social media:

Twitter

LinkedIn

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.